Stratospheric prices

Digital artist Beeple sold the NFT (non-fungible token) of a JPG file for a whopping $69 million. There are plenty of other digital pictures sold for millions of dollars such as CryptoPunk’s computer-generated pixel art of an alien and a picture of a rose by artist Kevin Abosch. The NFT art market is now worth over half a billion dollars.

And this is just a sliver of the multi-billion-dollar NFT market.

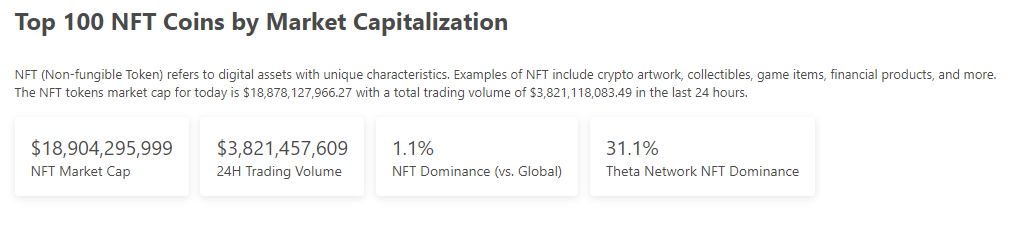

Statistics from CoinGecko

NFTs can be made of not just digital images, but literally countless other digital things. Twitter co-founder sold an NFT of his first-ever tweet for $2.9 million. Even the creator of the world wide web, Sir Tim Berners-Lee, who famously decided not to patent the world wide web to keep it free, sold the NFT of its original source code for $5.4 million.

NFT in layman’s terms

As the name suggests, a non-fungible token (NFT) is a one-of-a-kind, unique digital unit of data otherwise known as a ‘token’. The blockchain technology that underpins NFTs certifies the token’s identity. When a NFT is first added to the blockchain, it is “signed” by the uploader which ties the uploader to the NFT. Similar to a signed deed, NFTs are merely proofs of ownership, not the item itself.

NFTs are not Bitcoins or any other cryptocurrency even though they leverage the same technology. Unlike NFTs, cryptocurrencies are fungible; a Bitcoin has the same value as another Bitcoin and there are millions of other Bitcoins with the same value just like your cash note.

An inevitable rise that capitalizes on human nature

Real ownership

Perhaps the biggest selling point of NFT is that it proves a rightful owner, and this can be easily verified by the blockchain. Once you buy an NFT, you can store it in your cold digital wallet securely forever. You can easily prove you own this NFT and in turn prove that you are the rightful owner of the item it represents. An indestructible, infallible, perpetual, and undisputable ownership. How enticing is that?

If that is not enough, depending on your country, when you buy an NFT, you may also acquire the copyright in the underlying work.

Digital scarcity

Similar to Bitcoin, NFT prices are fueled by a concept called Digital Scarcity where the supply of digital assets is hardwired to be limited to a certain amount. This helps make NFTs a Veblen good. It is exclusive and the item it represents is often perceived as high quality. Veblen goods follow a different market pricing. Very often when the prices go up, the demand for it goes up as well.

Pander to our ego

In 2008, an iOS application named I Am Rich was launched in the App Store. It cost a grand and its function? Display the text “I am rich. I deserve it. I am good, healthy & successful”. And, 8 people bought it. One of the buyers claimed that he bought it out of curiosity. In an attempt to replicate its success, an app called Richfy was released where people could pay money for their names to be displayed on its list. It is perhaps human nature to flaunt their wealth. There are countless other digital means that pander to such human needs and NFTs may just be one of them.

Pandemic-fueled retail therapy

A world infested by COVID-19 proves to be a perfect testing ground for digital technologies. People are spending more on virtual goods and services as they spend their lives glued to their monitor. No longer are we able to wear our drip jackets to clubs, but an NFT for a digital art piece might still make us classy, right?

Rocketing expectations

Anyone can create, buy, and sell NFTs. Multi-million-dollar NFT sales have been making headlines. It raises the billion-dollar question: Are NFTs the latest get-rich-quick scheme similar to cryptocurrencies?

Potential uses

While speculations have pushed up the prices of NFTs, the whole concept of NFT has many potential uses that the current market has yet to explore fully. Similar to cryptocurrencies, NFTs get rid of the middleman. Creation and transfer of NFTs can happen on many different platforms independently. Not only do NFTs protect intellectual property rights, creators of NFTs could automatically receive royalties whenever a copy of their work is sold. There are also plenty of other uses that open up new playgrounds for startups.

Startups love the concept

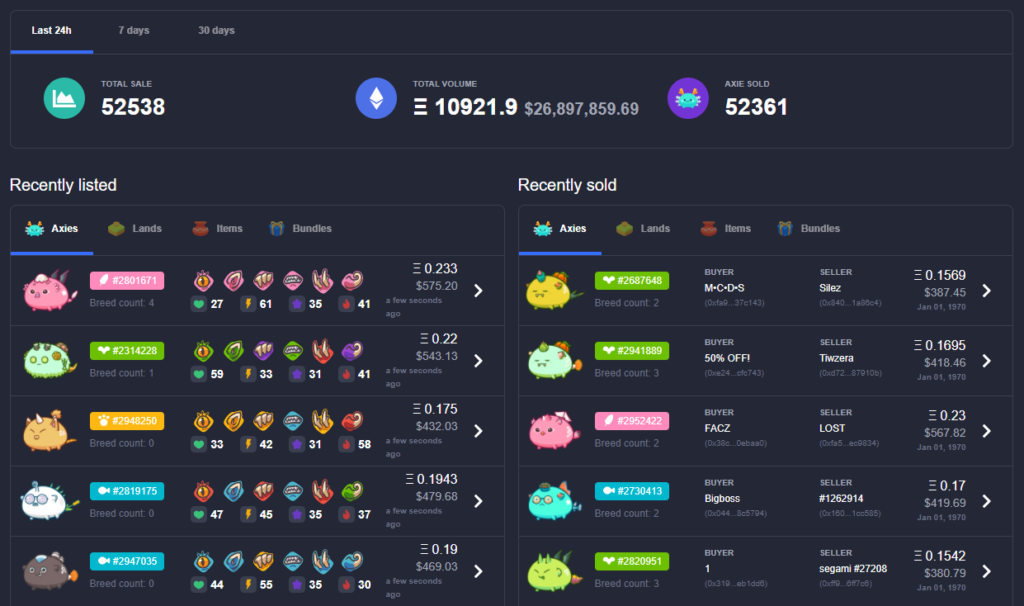

Many NFT games that allow players to create and trade in-game items have sprouted. NFT game, Axie Infinity, has posted nearly $100 million in weekly sales, and the number of daily active users in July 2021 is over 300 thousand, more than 30 times since the start of the year.

First-edition Charizard Pokemon cards can fetch hundreds of thousands of dollars. NFTs make great collectibles as they do not degrade and guarantee the item’s rarity. Earlier this year, Sorare, a fantasy football collectible game where players can trade player’s cards, raised $50 million in its series A funding. NFTs ensure that the cards are unique, and this digital scarcity has pushed the price of the card of one of the greatest footballers, Christiano Ronaldo, to over a hundred thousand dollars.

Axie Infinity marketplace

Where will it go from here?

NFTs remain a highly speculative asset with their sky-high prices. Just like other bubbles, the sales of NFTs have plunged from its all-time-high. However, companies worldwide are frantically hopping on the blockchain and NFT bandwagon, and they continue to find use cases for NFTs. With its promises on democratisation, NFTs may soon go even more mainstream and become a thing of the people.